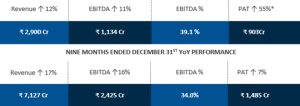

– REVENUE AT INR 2,900 CRORES, UP 12% YoY

-EBITDA AT INR 1,134 CRORES; PAT AT INR 903 CRORES

– REACHES A PORTFOLIO OF 617 HOTELS; INDUSTRY LEADING PIPELINE OF 256 HOTELS

TTT NEWS NETWORK

MUMBAI | 12 FEBRUARY 2026

The Indian Hotels Company Limited (IHCL), India’s largest hospitality company, reported its consolidated financials for third quarter and nine months ending December 31st, 2025.

CONSOLIDATED FINANCIAL RESULTS FOR Q3 AND NINE MONTHS ENDED 31ST DECEMBER 2025 Q3 YoY PERFORMANCE

* PAT is after Exceptional Items which mainly include Profit on Sale of entire equity stake in a joint venture company of INR 327 crores (net of tax) and an impact on account of New Labour Codes of INR 37 crores (net of tax). PY 9M PAT included one-time exceptional gain of INR 307 Cr on account of TajSATS consolidation

Mr. Puneet Chhatwal, Managing Director & CEO, IHCL, said, “Q3 FY2026 marks fifteenth consecutive quarter of record performance with a Consolidated revenue of INR 2,900 crores, a 12% growth over the previous year, EBITDA of 1,134 crores and an EBITDA margin of 39.1%. The revenue in the quarter was driven by a strong same store performance, not like for like growth, supported by a 17% growth in airline and institutional catering and 31% growth in New Businesses. The hotel segment reported a revenue of INR 2,579 crores resulting in the best ever quarterly EBITDA of INR 1,050 crores.”

He added, “IHCL continued its growth momentum in FY2026 with 239 signings to reach a portfolio of 617 hotels and opened and onboarded 120 hotels, led by strategic partnerships and acquisitions. Under Accelerate 2030, IHCL expanded its brandscape with the acquisition of controlling stake in Atmantan, an integrated wellness brand and entered into definitive agreements to acquire 51% stake in Brij, a boutique experiential leisure offering and scaled the Ginger brand with 51% acquisition in ANK & Pride Hospitality. IHCL Consolidated continues to maintain a healthy balance sheet with a gross cash balance of INR 3,877 crores as on 31st December 2025. IHCL is well placed to deliver sustained performance enabled by a diversified topline across brands, geographies and contract types.”

PILLARS OF DIVERSIFICATION HIGHLY DIVERSIFIED BUSINESS MODEL

Mr. Ankur Dalwani, Executive Vice President and Chief Financial Officer, IHCL said, “For Q3 FY2026, IHCL Standalone reported a revenue of INR 1,654 crores, clocking a strong EBITDA margin of 48.2%, an expansion of 40 basis points and a PAT of INR 921 crores post Exceptional Items.”

He added, “During the nine months ending December 2025, IHCL Consolidated generated cash of about INR 1,600 crores and undertook capital expenditure to the tune of INR 750 crores towards greenfield projects at Ekta Nagar, Taj Frankfurt, brownfield expansion at Taj Ganges Varanasi and the upcoming Taj Bandstand project along with renovations to key hotels such as Taj Palace Delhi, Taj Fort Aguada Goa, President Mumbai and St James Court London among others.”

Q3 – KEY HIGHLIGHTS

FINANCIAL PERFORMANCE

– Consolidated same store hotels delivered a 9% RevPAR growth.

– Management Fee income grew by 15% to INR 203 crores on the back of not like for like growth.

PORTFOLIO GROWTH – YEAR TO DATE

– IHCL signed 239 hotels across its brandscape including entering into strategic acquisitions and partnerships with Clarks Group, Madison, Rajdarbar Group, Ambuja Neotia and Atmantan brand.

– IHCL opened and onboarded 120 hotels taking our operating hotels to 361 with an inventory of

over 32,000 rooms.

NEW & REIMAGINED BUSINESSSES

– The Air & Institutional Catering business segment (TajSATS) clocked a revenue of INR 323 crores, 17% growth over the previous year and EBITDA margin at 26%.

– New Businesses comprising of Ginger, Qmin, am㠓tays & Trails and Tree of Life reported an Enterprise revenue of INR 316 crores, a growth of 39% and Consolidated revenue of INR 215 crores, a growth of 31%.

– Enterprise Revenue of Ginger stood at INR 232 crores with a strong EBITDAR margin of 47%.

– Qmin has grown to 110 outlets across multiple formats, am㼳pan style=’letter-spacing:-.2pt’> Stays & Trails has reached a portfolio of 351 bungalows with 176 in pipeline and Tree of Life is at a 27 resorts portfolio with

9 in pipeline.

PAATHYA | IHCL’S INDUSTRY-LEADING ESG+ FRAMEWORK

About The Indian Hotels Company Limited:

The Indian Hotels Company Limited (IHCL) and its subsidiaries bring together a group of brands and businesses that offer a fusion of warm Indian hospitality and world-class service. These include Taj – the iconic brand for the most discerning travellers and ranked as World’s Strongest Hotel Brand 2025 and India’s Strongest Brand 2025 as per Brand Finance; Claridges Collection, a curated set of boutique luxury hotels merging elegance with historical charm; Brij, an experiential leisure offering; Atmantan, one of India’s leading integrated wellness destinations; SeleQtions, a named collection of hotels; Gateway, full-service hotels designed to be your gateway to exceptional destinations; Vivanta, sophisticated upscale hotels; Tree of Life, private escapes in tranquil settings and Ginger, which is revolutionising the lean luxe segment.

Advertisement:

Add Comment