BY TTT NEWS NETWORK

MUMBAI, 3 FEBRUARY 2023

Thomas Cook India riding a robust growth in across all business segments has registered a third consecutive profitable quarters and expects a profitable fiscal 2023.

Income from Operations for Group grew YoY by 105% in Q3 FY23 to Rs 15,363 Mn and operational profit before tax ( PBT) at Rs 584 Mn Vs a loss of Rs 289 Mn reflecting strong recovery and business momentum across segments.

The Group continues to post robust results across all businesses during FY23. Income from operations segment wise YoY increase: Forex: 113%, Travel: 141%, Leisure Hospitality and Resorts (Sterling Holidays): 8%, Digital Imaging Solutions (DEI): 57% Sustained cost optimization across the Group visible in 18% savings over pre pandemic levels.

The Group maintains a strong financial profile, with Cash and Bank balances of Rs 10.58 Bn as of 31 Dec, 22 up from Rs. 9.13 Bn as on Sep 30, 2022. CRISIL upgrades Rating Outlook to Stable; Reaffirms Ratings (Long term CRISIL A+; Short term CRISIL A1) reiterating TCIL’s dominant position in Forex and strong brand equity across Travel businesses.

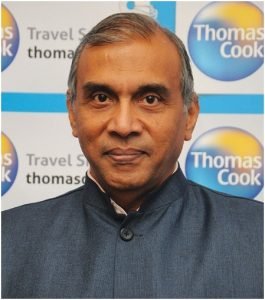

Mr. Madhavan Menon, Chairman and Managing Director, Thomas Cook (India) Limited said, “I am pleased to share the Group’s robust all-round performance for the quarter ended 31st December 2022. Across Travel, Foreign Exchange, Digital Imaging and Leisure Hospitality we have registered a strong bounce back versus pre pandemic levels. Given the strong positive economic and customer sentiment – reflected in our forward booking trends, we expect a profitable FY 2023. Our focus going forward, is to scale up and maximize growth – via our sustainable cost saving initiatives and efficiency-focused technology enhancements implemented across the Group.”

Business Segment-wise Performance:

Foreign Exchange-

Retail recovery at over 107% of pre pandemic levels

Overseas education segment at 128% of pre pandemic levels

New card issuance in Q3 FY23 was up by 72% QoQ; at 142% of pre pandemic levels

Card Loads of US$143 Mn for Q3 FY23 surpassed pre pandemic levels

Over 70% of the Card users below the age of 40

On-boarded 123 new B2B partners for FX Mate in Q3 FY23; growth of 7% QoQ

Travel and Related Services-

Corporate Travel-

Corporate Travel turnover grew by 120% YoY; surpasses pre pandemic levels for the quarter

Acquisition of over 13 new accounts, across Banking and Insurance, IT Services, Infrastructure, Media & Entertainment, Telecommunications,Automobile, Consumer products, manufacturing, etc.

Over 60% adoption by clients on the corporate self-booking tool

Meetings-Incentives-Conferences-Exhibitions (MICE)-

Mid to large size groups successfully managed – between 100 to 3000 delegates each

Managed multiple corporate groups for the T20 World Cup in Australia also the FIFA World Cup in Qatar

Inbound group of 400 customers in NCR; 6000 delegates from across 130 countries in Mumbai – including UK, USA,Singapore, Australia and Africa

Leisure Travel

Marked improvement in Sales: growth of 98% YoY; surpassing pre pandemic levels

Witnessed decrease in average age of customer by 10 years – reflects resonance with India’s young demography

Launches range of new products/deals with aggressive online campaigns targeting Gen Z/Young India

With over 7500 booked customers since restart – the highest sellers of Cordelia Cruises

Destination Management Services Network-

India – Travel Corporation (India) Limited: Revival witnessed this quarter with a healthy contribution margin.

Business is reviving and with UK e-visa issue resolved; further growth anticipated in the coming quarter. Travart project (to digitally transform TCI and be future ready) on track

Middle East – Desert Adventures: Q3 FY23 being peak season witnessed higher volumes Vs the previous quarter. Key volume drivers were CIS countries, OTA business, LATAM and India markets. Focus going forward will be to nurture and sustain CIS market, growth in other European markets (UK, Italy and France), consolidating local market presence and expanding footprint in the subcontinent market

East Africa – Private Safaris: Healthy sales in Q3 FY23 with volumes from traditional markets such as Germany, UK and US; also Romania, France and India

USA – Allied TPro: Sales in Q3 FY23 despite being the lean season recorded a fair growth over pre pandemic quarter

sales. Cost synergies and JV benefits also witnessed

Asia Pacific – Asian Trails: Gradual uptick in sales due to re-opening of key destinations (e.g. Thailand, Indonesia, Vietnam, Malaysia, Singapore and Cambodia). Sales have increased sequentially QoQ. Sales from e-connect (Online – B2B) picking up since launch in November 2022

Advertisement:

Add Comment